5 Simple Techniques For Prf Insurance

Wiki Article

Examine This Report on Prf Insurance

Table of ContentsPrf Insurance Things To Know Before You Get ThisPrf Insurance - TruthsExcitement About Prf InsuranceThe Main Principles Of Prf Insurance The Only Guide to Prf Insurance

Ranch and cattle ranch building insurance coverage covers the assets of your farm and also ranch, such as animals, equipment, buildings, installments, and others. Consider this as commercial home insurance that's entirely underwritten for organizations in agriculture. These are the typical insurance coverages you can get from ranch as well as ranch building insurance coverage. The devices, barn, machinery, tools, livestock, products, as well as equipment sheds are valuable possessions.Your ranch and also cattle ranch makes use of flatbed trailers, enclosed trailers, or energy trailers to haul goods and equipment. Commercial car insurance coverage will certainly cover the trailer yet only if it's affixed to the insured tractor or truck. If something takes place to the trailer while it's not attached, after that you're left on your own.

Employees' payment insurance policy gives the funds a staff member can use to purchase medicines for a job-related injury or illness, as suggested by the medical professional. Workers' settlement insurance covers rehabilitation. It will also cover retraining costs so that your employee can resume his task. While your worker is under rehabilitation or being educated, the plan will provide an allowance equivalent to a percent of the ordinary regular wage.

You can guarantee yourself with employees' compensation insurance coverage. While buying the policy, carriers will certainly give you the freedom to include or exclude yourself as a guaranteed.

Prf Insurance Things To Know Before You Get This

To get a quote, you can function with an American Household Insurance policy representative, conversation with representatives online, or phone American Family 24-hour a day, 365 days a year. You can file a case online, over the phone, or directly with your agent. American Household has been in organization given that 1927 and is trusted as a carrier of insurance policy for farmers.And also, there are a couple of different sorts of ranch truck insurance plan readily available. The insurance policy needs for each and every kind of vehicle differ. By investing simply a little time, farmers can expand their expertise about the different types of ranch trucks and choose the most effective as well as most affordable insurance coverage services for each.

Regardless of what provider is composing the farmer's auto insurance plan, heavy and extra-heavy vehicles will certainly need to be put on a commercial vehicle policy. Trucks titled to a business ranch entity, such as an LLC or INC, will require to be positioned on an industrial policy no matter the insurance provider.

The Best Strategy To Use For Prf Insurance

If a farmer has a semi that is utilized for transporting their very own ranch products, they might have the ability to include this on the exact same industrial automobile plan that guarantees their commercially-owned pick-up trucks. If the semi is used in the off-season to transport the products of others, most basic ranch and industrial automobile insurance coverage providers will not have an "hunger" for this kind of threat.A trucking policy is still a commercial auto plan. The carriers who use coverage for operations with cars utilized to haul goods for 3rd celebrations are usually specialized in this type of insurance policy. These types of procedures create higher threats for insurance providers, larger insurance claim volumes, and a greater severity of cases.

A seasoned independent representative can assist you analyze the kind of plan with which your commercial automobile need to be guaranteed as well as explain the nuanced implications as well as insurance coverage implications of having numerous automobile policies with numerous insurance coverage carriers. Some vehicles that are utilized on the farm are guaranteed on personal car plans.

Commercial automobiles that are not eligible for an individual car plan, however are utilized exclusively in index the farming procedures supply a minimized risk to insurance provider than their industrial use equivalents. Some service providers decide to guarantee them on a ranch car policy, which will certainly have a little different underwriting standards and rating frameworks than a routine commercial automobile plan.

3 Simple Techniques For Prf Insurance

Many farmers relegate older or restricted use vehicles to this kind of registration because it is a cost-effective means to maintain a vehicle being used without all of the additional expenses normally linked with vehicles. The Division of Transportation in the state of Pennsylvania categorizes several various kinds of unlicensed ranch trucks Kind A, B, C, as well as D.Time of day of usage, miles from the home navigate to this site ranch, and various other constraints relate to these kinds of vehicles. So, it's not a great idea to entrust your "everyday motorist" as an unlicensed farm vehicle. As you can see, there are multiple sorts of ranch truck insurance plans readily available to farmers.

The 5-Second Trick For Prf Insurance

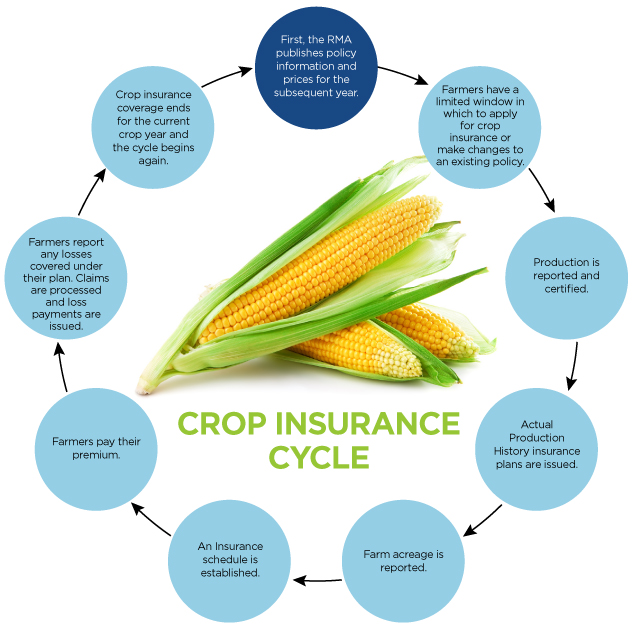

Please note: Details and claims provided in this web content are suggested for interesting, illustrative functions and should not be considered lawfully binding.Crop hail storm coverage is sold by exclusive insurers and also regulated by the state insurance policy divisions. It is not part of a federal government program. There is a government program supplying a variety of multi-peril crop insurance coverage items. The Federal Plant Insurance coverage program was created in 1938. Today the RMA administers the program, which offered plans for more than 255 million acres of land in 2010.

Unlike other sorts of insurance policy, crop insurance hinges on well-known dates that use to all policies. These dates are figured out by the RMA in advance of the planting period and published on its site. Days differ by crop and also by county. These read review are the vital dates farmers should expect to fulfill: All plant insurance coverage applications for the marked region and crop are due by this date.

Report this wiki page